What is OpenRoaming?

- Higher quality of service

- No need to track or switch among SSIDs

- A single log-on experience

- Business incentives, primarily through simplicity, to adopters

- Ease of regulatory compliance

- Passive authentication

Fundamental Advance Research Consultancy in Communication (xgnlab) - "Delivering Innovation".

Spectrum harmonisation continues to be important for the mobile industry in the 5G era. Globally harmonised spectrum enables economies of scale and facilitates cross-border coordination and roaming for end users: a critical factor for the initial deployment of 5G. Regulators and the industry should take immediate action towards the following objectives:

1. Spectrum should be allocated to Mobile Service on a primary/co-primary basis globally or regionally,

2. Consistent frequency arrangements (including band plan and duplexing mode) should be adopted across all markets,

3. Consistent regulatory frameworks should be strived for – same technical conditions should govern the use of particular frequency bands (e.g. emission masks ensuring sharing and coexistence with other services in the same band or in adjacent bands),

4. Harmonised standards: the same technology standard should be adopted. ITU-R Working Party 5D is leading the development of IMT-2020 standards and the mobile industry is working on 3GPP 5G-NR as the harmonised standard for 5G.

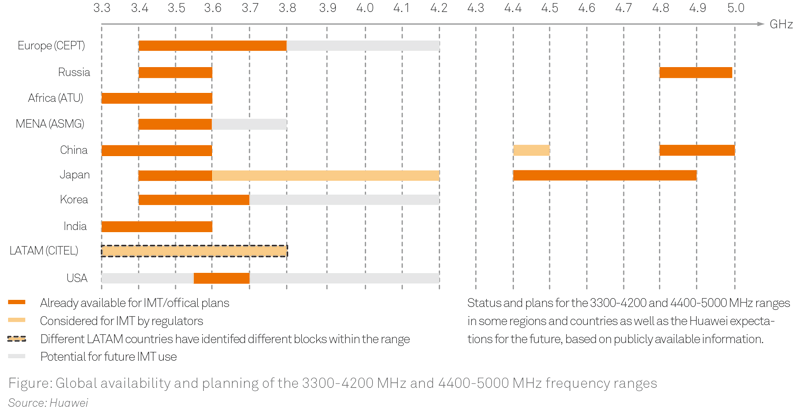

Spectrum availability for IMT in the 3300-4200 and 4400-5000 MHz ranges is increasing globally. The 3400-3600 MHz frequency band is allocated to Mobile Service on a co-primary basis in almost all countries throughout the world. Administrations will make available different portions of the 3300-4200 and 4400-5000 MHz ranges at different times, incrementally building large contiguous blocks.

The 3GPP 5G-NR specification will support 3300-3800 MHz from the start, using a TDD access scheme. In line with the release plans from many countries, the 3300-3800 MHz band will be the primary 5G band with greatest potential for global harmonisation over time: it is recommended that at least 100 MHz of contiguous bandwidth from this band be allocated to each 5G network.

In order to take advantage of the harmonized technical specification – the 3GPP 5G NR specification for 3300-3800 MHz band, regulators are recommended to adopt a frequency arrangement with an aligned lower block edge of usable spectrum and harmonized technical regulatory conditions, at least in countries of the same Region.

The 5G-NR ecosystem of 3300-3800 MHz is expected to be commercially ready in 2018[1],[2] . As a first step, it is highly recommended that countries allocate 3300-3800 MHz or a portion of it and make it available for 5G with consistent timelines and regulatory frameworks (i.e. frequency arrangements and emission masks). Work is ongoing in CEPT ECC PT1 towards the development of the regulatory technical conditions for the 3400-3800 MHz for 5G in Europe, and the final decisions will be published in June 2018 and will represent an important reference also for countries from other regions.

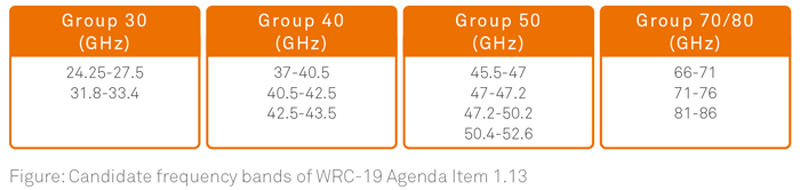

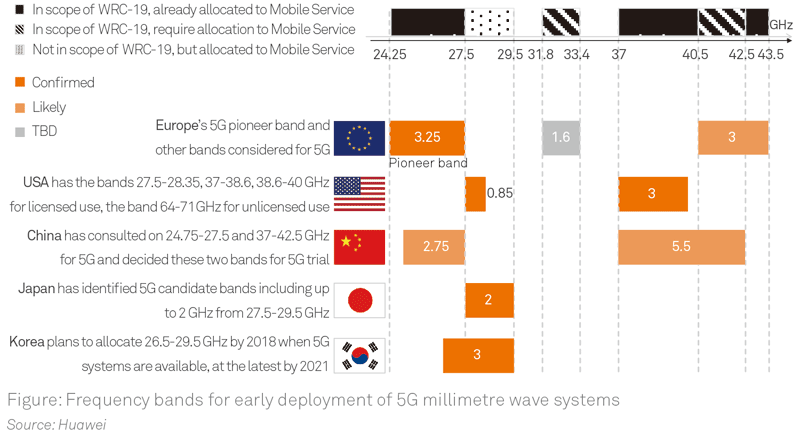

The World Radiocommunication Conference 2015 (WRC-15) paved the way for the future development of IMT on higher frequency bands by identifying several frequencies for study within the 24.25-86 GHz range (Figure 4) for possible identification for IMT under Agenda Item 1.13 of WRC-19. The 24.25-27.5 and 37-43.5 GHz bands are prioritised within the ongoing ITU-R work in preparation for WRC-19; all regions and countries are recommended to support the identification of these two bands for IMT during WRC-19 and should aim to harmonise technical conditions for use of these frequencies in 5G.

The frequency band of 27.5-29.5 GHz, though not included in the WRC-19 Agenda Item 1.13, is considered for 5G in the USA, South Korea and Japan.

The 24.25-29.5 and 37-43.5 GHz ranges are the most promising frequencies for the early deployment of 5G millimetre wave systems, and several leading markets are considering portions of these two ranges for early deployments (Figure 5), and the two ranges are also being specified in 3GPP Release 15 based on a TDD access scheme[3] . It is recommended that at least 800 MHz of contiguous spectrum per network from these ranges be assigned for the early deployment of 5G. For countries that plan to release 26.5-27.5 GHz as first step, it is recommended that at least 400 MHz of contiguous spectrum per network be assigned; the remaining 24.25-26.5 GHz should be allocated as soon as practicable and specific provisions should be added to avoid fragmented assignments across the overall 24.25-27.5 GHz range.

CEPT ECC PT1 is developing regulatory technical conditions for the 24.25-27.5 GHz band for mobile use in Europe, which may differ from the conditions agreed for 27.5-28.35 GHz in the USA. If this happens, it would be difficult to achieve spectrum harmonisation. Many other countries will decide the regulatory technical conditions for 24.25-27.5 GHz after WRC-19 confirms the criteria to protect incumbent services. These factors may delay 5G-NR ecosystem development for high frequency bands. Huawei encourages regulators to address these issues to allow the ecosystem over high frequency bands to be ready from 2020.

The L-band (1427-1518 MHz) is another 5G candidate band that has the potential to be allocated to mobile in most countries in the world. CEPT and CITEL regions have adopted the SDL (Supplemental Down Link) scheme for this band. The requirement for standalone operation in the band (both UL and DL transmissions) has emerged in some other regions. In the case of standalone 5G systems, a TDD access scheme is a potentially appropriate option, which can accommodate traffic asymmetry in the UL/DL directions with good potential for economies of scale. The same 5G-NR equipment can serve both the TDD and SDL markets.

The 700 MHz band has already been harmonised for mobile in most countries. Europe plans to use this band for 5G. Over the long term, the other frequencies of UHF band (470-694/698 MHz) could also be used for mobile, while the USA has already started the process of transferring the band from broadcasting to mobile service.

[1].GSA White Paper: "The future development of IMT in 3300-4200 MHz band", June 2017. https://gsacom.com/.

[2].China IMT-2020 Promotion Group, "IMT-2020 Trial Progress", a key note speech at the PT-EXPO China, September 2017

[3].3GPP RP-172115, "Revised WID on New Radio Access Technology"